Authors

Daniel Galis, Associate, Energy

Decarbonizing heat generation and use in industries represents a major challenge in the energy transition. Heat accounts for most of Scope 1 and Scope 2 emissions for industrial businesses in sectors such as food and beverage, paper and pulp, fast-moving consumer goods, and chemicals. In 2021, the way we generated and used heat was responsible for a total of 14.1Gt CO2, equal to 39% of all energy-related CO2 emissions.

An additional 15EJ of renewable heat must be generated by 2028 to achieve net-zero by 2050 – an ambitious goal compared to the mere 2.5EJ added in the past five years. So far, the uptake of modern renewable heating technologies has been limited due to the lack of awareness about viable options, high investment and upfront costs, and local barriers associated with renewable heating solutions – among others, the availability of land and solar radiation for solar thermal as well as availability of additional electricity supply for heat pumps. According to the IEA, emerging business models, including Heat-as-a-Service (HaaS) can help us overcome some of these challenges by mobilizing the necessary investments.

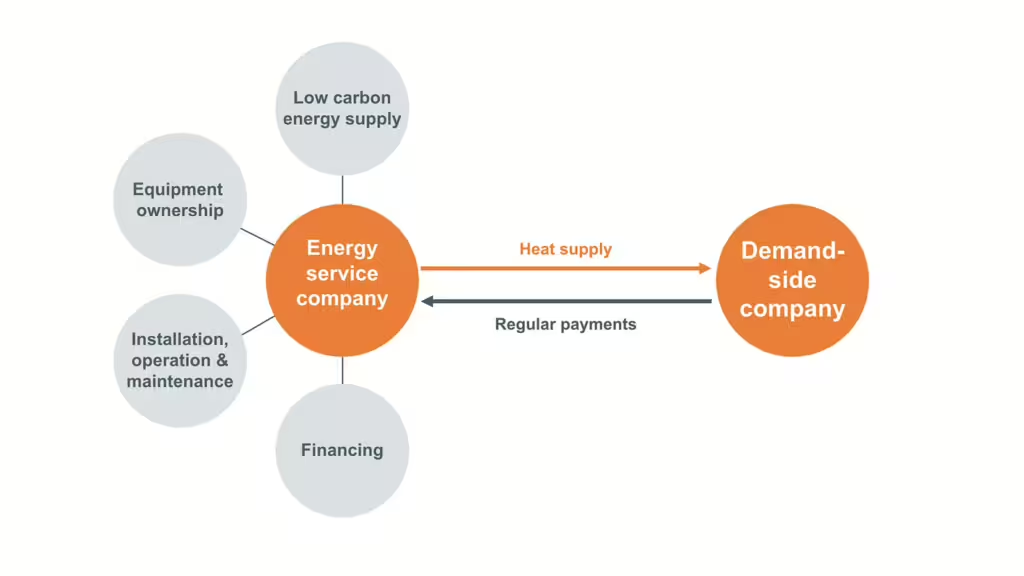

HaaS is a financing model in which an industrial company outsources its heating needs to a specialized provider, an energy service company (ESCO). The ESCO finances, builds and operates the renewable heat generation asset and subsequently sells the heat produced to the industrial company.

The Heat as a Service structure

The HaaS arrangement enables a company to access decarbonized heat, replacing fossil fuels and realizing operational cost savings, all without the need for an upfront investment. The ESCO contributes with its specialized knowledge in developing, optimizing, and integrating a broad spectrum of renewable heating technologies. As the ESCO owns the asset, it is motivated to choose the most effective solution and constantly innovate to improve performance. Meanwhile, the industrial company can avoid the ancillary costs associated with new technologies, such as staff reskilling, and focus internal financial and personnel resources towards its core business instead of energy supply.

Headwinds to large scale adoption

While the HaaS model offers compelling advantages, many companies remain hesitant about its adoption. The biggest issue is the long-term nature of the contract, in place to allow the ESCO to recuperate its investment costs. Companies need to rely on the ESCO with their heat supply for the full 15 to 20-year typical duration of the contract. Importantly, any technical, operational, or financial difficulties encountered by the ESCO throughout this time could result in disruptions to heat provision. As industrial companies typically require stable heat input, such disruptions would interrupt their production and lead to losses in revenue. Because of this, HaaS is often considered as a leap of faith for companies accustomed to owning their own heat generation assets. For HaaS to be seen as a potential solution, the organizational mindset would need to shift significantly.

In our journey towards Net Zero on our Low Carbon Transition Plan, decarbonizing heating to reduce our scope 1 emissions is crucial. For international businesses in general, many with factories worldwide running at high capacity, a steady supply of thermal energy is vital for business continuity.

– Philip Morris International

Another challenge is posed by the fact that heat needs to be consumed close to its generation point as it cannot be transported over long distances. Unlike Power Purchase Agreements (PPAs), which may be more easily transferable between sites within a single jurisdiction, the mobility of HaaS contracts is constrained by the physical infrastructure. Any transfer would necessitate the equipment’s relocation, which, even if technically possible, would lead to supply interruptions and financial losses for the industrial company. The limited transferability of HaaS agreements creates additional complexity and poses a specific challenge in case of any unexpected reduction in the energy demand at the production site.

While HaaS shows great promise as a potential solution for decarbonization across different contexts, because it’s in the early stages, its viability requires further proof through real projects. For example, potential challenges like bankability, supplier reliability, geographical factors, global energy price fluctuations, and contractual tenures could make HaaS adoption complex.

– Philip Morris International

How to deliver a successful HaaS project?

Engaging in a dialogue with WBCSD members and industry experts, we analyzed existing projects based on HaaS agreements and identified three key learnings that address some of the concerns and reveal valuable lessons from real-life implementations.

1. Prioritize finding a committed, flexible, and stable HaaS partner

The adoption of HaaS extends beyond a typical supplier-client dynamic, evolving into a long-term partnership. Companies stress the significance of selecting the right trustworthy and reliable partner early in the project’s timeline. Because of this, ESCOs should employ novel approaches to build the relationship early on and mitigate any concerns faced by the industrial company. In some HaaS projects, ESCOs assume the full project risk until the renewable heat solution is operational, showing their commitment to the project. Similarly, other ESCOs offer short-term one-year-long HaaS agreements using a smaller pilot installation which can then be extended to a full project following the feedback from the industrial company.

Financial stability is another crucial factor companies look for, especially given the potential repercussions on production in the event of the ESCO’s financial distress. This is of particular concern because, so far, the market has been primarily served by startups. However, an increasing number of established utilities, such as Engie, are exploring HaaS. They can complement the services provided by the startups and alleviate many of the reliability and financial stability concerns.

One of the primary reasons we chose Engie as our partner was expertise. We, at Heineken, are experts in brewing beer but Engie is expert in providing energy solutions.

– HEINEKEN España

2. Develop a long-term energy procurement strategy

For a successful HaaS agreement, the ESCO needs to model the industrial company’s heat demand over the duration of the contract. This is necessary to scale and optimize the renewable heat solution to the right capacity and, in turn, lower the costs for the industrial company. HaaS, therefore, necessitates a certain level of maturity in the company’s energy procurement, so that it can anticipate its heat needs and develop an optimized cost-effective procurement strategy. At a minimum, companies need to have available data on their current heat profile and heat demand. Ideally, they should also develop a long-term energy and decarbonization strategy that maps their targets and requirements for the upcoming years. The HaaS contracts are then a powerful tool to enable long-term planning as they enable companies, similarly to power purchase agreements, to lock in their price of heat for years to come. This is particularly advantageous for companies that currently rely on natural gas which often suffers from volatile prices due to unpredictable geopolitical events.

Implementing HaaS requires mature internal energy procurement capabilities. Companies should be able to forecast their future energy demand, assess the impacts of carbon pricing, and have a clear decarbonization strategy.

– Newheat

Additionally, a well-defined energy and decarbonization strategy can help companies secure internal stakeholder alignment and support for renewable heat solutions. Tangible goals to reduce emissions from production focused on the near future up to 2030 prove vital to get projects off the ground and drive renewable heat adoption.

3. Leverage the HaaS partnership to acquire subsidies

While many renewable heat technologies for temperatures below 200°C are mature enough for commercial-scale deployment, they are often more expensive upfront than their fossil fuel counterparts. The true cost of carbon is often not properly reflected in investment decisions as well, making renewable heating solutions seem financially unviable. As the market expands and suppliers achieve economies of scale, utilities expect the costs to decrease significantly. For now, however, we are still in the early market stages and subsidies on both the investment and operational costs of renewable heat solutions are needed to enhance the commercial attractiveness of projects.

As a result, some ESCOs proactively look for subsidies to support their projects and help companies secure them as part of the HaaS agreement. Engie, for example, acquired the subsidy from the European Regional Development Fund which co-funded 60% of the investment costs required for its 30MW solar thermal HaaS project with Heineken in Seville. Additionally, the HaaS arrangement allows companies to benefit from governmental support for the operational costs, such as the Dutch SDE++, which covers the difference between the cost of conventional and renewable heat generation.

The time to decarbonize heat generation through HaaS is now

The partnership with energy experts via the HaaS model offers companies the comfort of specialized knowledge and reduces the need for substantial upfront investments, allowing them to concentrate their resources on core business operations. This is particularly valuable as modern renewable heating solutions are constantly evolving and developing. While there are inherent challenges to the HaaS model – such as long-term contract commitments and dependence on the ESCO’s financial stability – these can be mitigated by selecting a reliable partner and developing strategic long-term planning. Effectively implemented, the HaaS model can act as a key catalyst for the broader adoption of renewable heating solutions, driving industry towards a sustainable and net-zero future.

What’s next

You can find more information about the HaaS partnership between Heineken and Engie as well as about the largest solar thermal power plant in Europe in the accompanying case study on The Climate Drive. Additionally, WBCSD is continuously supporting companies in overcoming barriers to the decarbonization of their industrial heat needs. Please, reach out to Surbhi Singhvi or Daniel Galis if you would like to find out more.

Outline